So, you’ve been searching for some weird and wonderful facts about credit cards? You’ve come to the right place, continue reading for your mind to be potentially blown!

Credit Card History

Before we dive into some juicy credit card facts, we thought we’d share a brief history of credit cards and how they’ve evolved over the past century. The form of using credit (not on the plastic cards yet) as a method of payment dates back to the late 19th century when consumers and merchants exchanged goods using items such as charge plates and coins.

Fast forward around 50 years, and you’ll find the first bank card, named “Charg-It”, by a banker in Brooklyn by the name of John Biggins, according to MasterCard. Keep in mind though, these weren’t the plastic cards as we know them today. No, no, when a customer used these cards to make a purchase, the merchant would forward the bill to the card’s bank. From there the bank would reimburse the merchant, whilst seeking payment from the card holder. Still quite a manual process.

We’ll skip of a few of the in-between details and move on to the introduction of plastic cards. Diner’s Club was the first to bring about a universal credit card which could be used at a variety of establishments in 1950. American Express was quick to follow with a travel and entertainment card made public in 1958. However, these cards were still technically charge cards, as they required payment in full at the end of each month.

1959 saw the first plastic credit card released to the world, by American Express. Bring it up another seven years to 1966, and the general-purpose credit card was born. BankAmericard (now known and Visa) and the Interbank Card Association (now known as MasterCard) were the first to issue credit cards through its member banks and maintain the rules for their processing.

From there, the 21st century credit card continued to evolve into an ever fascinating piece of technology. Credit cards are currently undertaking a major change throughout the world. Many banks are phasing out the swipe technology in place for the new EMV compliant chips.

OK, know we know a bit about the evolution of credit cards, we can move on to the fun part…crazy facts about credit cards!

23 Interesting Credit Card Facts

| Fact 1 – There were 1.167 billion credit cards in circulation in 2012.

Across the four primary credit card networks (Visa, MasterCard, Discover, American Express), Visa was the most popular with 261 million cards, followed by MasterCard with 174 million, Discover with 59 million, and American Express with 52 million. Source: WalletHub |

| Fact 2 – Approximately 14 percent of the American population had more than 10 credit cards in 2007.

A quick calculation tells us that 14 percent of the 2007 population equates to 42.168 million consumers. So these 42 million people accounted for over 420 million credit cards. Big numbers! Source: Experian National Score Index study, February 2007 |

| Fact 3 – VISA stands for Visa International Service Association.

The word Visa itself, has no meaning in regards to credit cards, think how Google was just made up. VISA in regards to travelling to foreign countries, means Visitors International Stay Admission.

Source: Quora |

| Fact 4 – Total transactions in the US involving credit cards in 2012 rose to 26.2 billion for the year.

How many per day you ask? 71.78 million. How many per hour you ask? 2.99 million. How many per minute you ask?! 49.8 thousand. How many per second you ask!?!?! 830 credit card transaction per second in 2012. Crazy figures. Source: CreditCards.com |

| Fact 5 – Consumers under 30 years of age have the highest rate of falling behind more than 90+ days in payments.

Approximately 2.03% of those under 30 are 90+ days behind credit card payments for Q1 2015. Compared to only 0.70% of consumers above 60 years of age more than 90+ days late. Source: CreditCards.com |

| Fact 6 – Pay your credit card bill in full each month? You’re card issuer may have nicknamed you a deadbeat.

A large portion of banks and credit card companies make the majority of their revenue from interest and fees paid by cardholders. If you never carry a balance, or incur unnecessary fees, the organisation won’t make any money off of you, hence you’re a “deadbeat” to them. Don’t take it personally! Being a deadbeat in this situation is a good thing. Source: The Balance |

| Fact 7 – The most expensive credit card in the world requires an initiation fee of $7,500, with a recurring account fee of $2,500 yearly.

Which card you ask? You guessed it, it’s the American Express Centurion Card. It’s so exclusive, the card is invitation only, and there are reports that customers must be willing to spend around $250,000 or more on the card each year.

Source: Wikipedia |

| Fact 8 – If you lined up all the credit cards in the world side-by-side, you could span the moon nearly 14 times.

All the credit cards in the world lined up equate to around 90,000 miles or 145,000 kilometers, which could span the moon’s circumference of 6,785 miles or 10,921 km just under 14 times! Source: Statista.com |

| Fact 9 – Australian’s spend around $25 billion each month on credit card purchases as of September 2016.

Credit cards totaled around 207.5 million in Australia, with the average transaction purchase sitting at $122. Multiplied together, and Australian consumers spent nearly $25 billion on their credit cards in September 2016. Source: Finder.com.au |

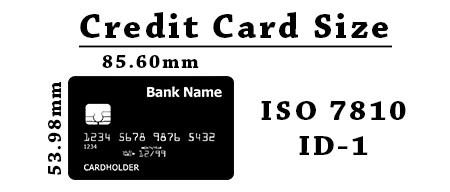

| Fact 10 – Every single credit card in existence is exactly the same size. Measuring 85.60 mm (W) x 53.98 mm (H).

International standardization has governed the card’s sizes. In particular for credit cards, the ISO 7810 ID-1 controls their sizes. Whilst ID-2 is used for French and other ID cards, ID-3 is used for passports, and ID-000 are used for the standard sim card sizes.

Source: Wikipedia |

| Fact 11 – In 2014, credit card companies spent an average of $80 to acquire every new customer.

Costs included marketing (such as brochures, TV, or radio) and various administrative costs. Keep in mind, if a customer keeps their card, they provide the bank with around $120 each year they use it. That’s a 50% return on investment! Not bad at all. Source: DB Marketing |

| Fact 12 – On average, women are more likely to incur late fees, carry a balance, or just make the minimum repayments on their credit card.

The study conducted by Finra found that women were 5 percent more likely to carry a balance, 4 percent more likely to pay the minimum payment, and six percent more likely to be charged a late fee. Source: Finra |

| Fact 13 – The first two numbers on your credit card actually relate to the issuing industry.

They aren’t completely random! If your card starts with a 1 or 2, an airline issued it. 3 as the first digit, relates to the travel and entertainment industry (think Amex and Diners Club). VISA cards all start with the number 4, whilst Mastercard opens with a 5. Merchandise and banking cards begin with a 6. Gas cards, such as Exxon or 7-Eleven start with a 7. Telecommunications organisations issue cards beginning with an 8, and lastly, national assignments start with a 9. Source: Super Money |

| Fact 14 – You can check if you credit card number is valid through a simple pattern check.

This is easier done with a piece of paper. So get out your credit card, a pen and some paper, and let’s get checking! First, we want to start from the right hand side. Then, starting from the first digit on the right, double every second digit until you get to the far left. Now, simply add up all the digits together. If you got a number that can be divided by 10, your card is valid! Source: Wikipedia |

| Fact 15 – You can most likely reduce your interest rate by simply threatening to move to another card.

This one comes under the list of important things for students to know about credit cards, think of all the savings! Look at it from their perspective, would the company rather make no money from you, or simply a bit less? Common sense should prevail on their behalf. Source: Wisdom! |

| Fact 16 – MasterCard is accepted in over 210 countries and territories worldwide.

Making the small, plastic card one of the most widely accepted products in the world. Even beating out McDonalds and the huge Coca-Cola!

Source: MasterCard |

| Fact 17 – 1984 was the first year in which hologram technology was used to deter credit card fraud.

With over 47 percent of the world’s credit card fraud originating from the United States, it’s no wonder organisations are doing everything possible to hinder these criminals with sophisticated technology. Source: Weebly |

| Fact 18 – Consumers typically respond to credit card offer in the mail around 0.33 percent of the time.

In number we can more easily comprehend, for every 1,000 brochures or leaflets sent out, only 3.3 people will inquire further. That’s a dismal response rate, even for credit cards. Tell us these aren’t interesting credit card facts! Source: The Financial Brand |

| Fact 19 – You thought 830 credit card transactions per second in the US was a lot? Try over 10,000 per second for the whole world.

600,000 per minute. 36,000,000 per hour. 864,000,000 per day. 31,536,000,000 per year. 315,360,000,000 per decade! OK, OK, we’ll stop there, but you get the picture. It’s a huge amount. Credit cards are widely used all around the world. Hang on, one more. With four babies born every second, that means every time a new life enters this world, credit cards are used 2,500 times. Insane! Source: American Bankers Association, March 2009 |

| Fact 20 – Credit cards can vary in weight, ranging from 4 grams to 12 grams.

Typically, cards will come in under 5 grams, as the lighter they are, the cheaper they are to manufacture. High end cards such as Chase Sapphire or Chase Marriott will weigh around 12 grams. Source: MyFico |

| Fact 22 – The black magnetic strip on the back of your card use technology that is fundamentally the same as that found in a cassette tape.

It was originally invented in World War II for recording audio on steel tape and wire. IBM used the magnetic tape idea in 1960 to develop a reliable way to secure these magnetic strips to plastic cards, such as the modern credit card. Source: Wikipedia |

| Fact 23 – $200 million was stolen in the largest ever case of credit card fraud which was shut down in 2013.

18 people were charged with allegedly creating thousands upon thousands of phony identities to steal $200 million in one of the largest international credit card fraud schemes charged by the US Department of Justice. The perpetrators fabricated identities to obtain credit cards and then spend as much as they could. Robbing the financial institutions of millions of dollars.

Source: FBI |

Submit Your Own Facts About Credit Cards

Thank you very much for taking the time to read through our list of credit card facts! We hope you found some of them interesting, funny, unusual, or maybe even a bit weird! Nevertheless, this concludes our 23 credit card facts in 2016.

We’re always looking to improve upon the list, so if you know any more crazy facts about credit cards, or maybe some facts about debit cards, heck, even some credit card statistics, we’d love to hear them!

Please contact us today with your interesting facts and we’ll be sure to add them in.