ASB has started a new initiative to inspire children to start saving, and eventually learn about the financial aspects of life.

1. They’re bad at Derivatives

According to these figures released by the Reserve Bank of New Zealand (RBNZ), for the past two years, banks have had no idea what they’re doing with derivatives.

Take a look at the table below. You see those numbers in red? Yep, they’re the combined loss in derivatives for all the registered banks in New Zealand.

| Dec 2014 | Mar 2015 | Jun 2015 | Sep 2015 | Dec 2015 | Mar 2016 | Jun 2016 |

| -$432 | -$245 | -$306 | -$197 | -$2 | -$373 | -$83 |

Before you go on, no, that isn’t a loss of $432. That’s a loss of $432 million. These numbers aren’t something to turn your head at.

Three possible scenarios could have caused this:

- 1 – Some banks are making profits in the division, whilst others are simply making higher losses

- 2 – All banks are making losses and no one knows what they’re doing, or

- 3 – Everyone’s making a profit and the RBNZ have completely muddled the figures

You choose.

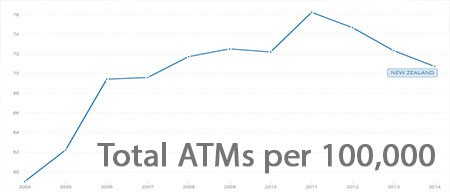

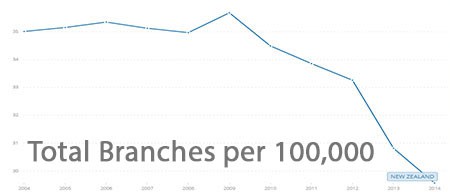

2. ATMS and Branches are DECLINING

The digital world is upon us, and banks are starting to realise that the old-school brick and mortar style banking facilities are starting to become less and less popular.

ATM’s reached their peak in 2010 with 76.244 machines per 100,000 adults in New Zealand. They’ve declined nearly 8% to 2014 with only 70.738 machines per 100,000.

Branches reached their peak slightly earlier in 2009 with 35.676 per 100,000. The next five years saw a steep decline of nearly 17% of all branches closing down.

As you’ve seen more recently, we expect the decline to branch closures to continue with some banks making more announcements this year.

3. BPAY is growing…FAST

BPAY (technically called Bill Payments) are the fastest growing payment instrument out of direct debits, automatic payments, and direct credits.

The total transaction value of BPAY grew nearly 20% for the year up to October 2015. Total number of transactions incurred a slightly lower growth of 7%, but still the fastest nonetheless.

And if you weren’t already aware, cheque payments are leaving our hands faster than ever. With the volume of cheques halving from October 2012 to October 2015. An annual decline of 22.4%.

4. Credit/Debit Cards per capita

PaymentsNZ just released a benchmark of the country’s payment systems compared to Australia’s. One of the the indicators on the list was the number of plastic cards per capita (per person).

And New Zealand came out on top! Only slightly though. The number of cards per person are separated by just 4.5%

- Australia: 2.75 debit and credit cards per capita

- New Zealand: 2.88 debit and credit cards per capita

There you have it folks, some of the interesting facts we were able to find on New Zealand banks.

Make sure to check out the rest of the site for all the information your heart could desire on banking and financial institutions in New Zealand.